QUICK LINK Payment : Make online transactions faster, easier and secure with Khalti.

Are you tired of receiving fake orders or have problems grabbing your customer’s trust to pay for your personal wallet? We have a quick solution to these problems introducing QUICK LINK Payment. Boost your business by using our payment gateway which needs no additional physical devices or machines. With just one click create a shareable link and accept payments from any part of the world. No websites or platforms? No worries, just use QUICK LINK.

We have solved the payment problems of merchants across Nepal and are excited to introduce our new payment option. It is the best payment option for merchants having no own apps or websites. All you have to do is generate a shareable link easily via our merchant dashboard and start accepting payments. Secured payment limiting the challenges has never been this easier. Our QUICK LINK payment doesn’t require any technical integration. All you have to do is to create a link and start accepting payments. By sharing links with your customers, you can avoid receiving fake orders and make them feel secure about paying through your wallet.

Quick Pay Service gives you the further options:

- Payment Link

- Track Payment Status

- Easy Refund

- Transaction Report

- Bank Transfer

- Merchant Support

- East to use Dashboard

and many options & features are waiting for you in our user friendly merchant dashboard like:

- Striking and super analytical dashboard.

- The payment link can be generated with a single click.

- Merchants can create the required number of users for transaction verification and reconciliation.

- Payments can be received from any part of the world.

- Full detailed transaction reports for better decision-making.

Unlocking the Benefits of QUICK LINK Services: Why You Should use It :

- Quick Pay service will extend the scope of online payment gateways to offline markets. Merchants not having their website and platform will be able to receive payments via Cybersource just by generating and sharing the payment link to the end user.

- Suitable for all kinds of business.

- Best for newly established e-commerce companies transacting mostly over social media, telephone, e-mails, etc.

- Hybrid model suitable for both over-the counter and MOTO transactions.

- No need for additional physical devices/machines.

Why use QUICK LINK over QR payments?

|

Quicklink |

QR |

|

|

Use |

For businesses that want to offer a quick and frictionless payment experience |

QR is not interactive and may require technical knowledge. |

|

Requirements |

It doesn’t require any special hardware or software, and it works across different platforms and devices. |

QR codes require users to have a compatible device and app that can read and process the code |

|

Security |

Secured links are verified at multiple stages |

QR codes may be subject to security risks, such as phishing attacks or malware |

| Accessibility |

Can be accessed through a variety of channels, including SMS, email, social media, and messaging apps. |

Need device with a camera or application to process the QR |

| Convenience | Quick Link may be more convenient for users who prefer not to download a mobile payment app or who are making a one-time payment. |

QR codes need additional apps to be generated. |

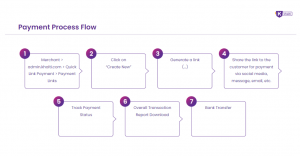

Payment Process Flow:

System Overview

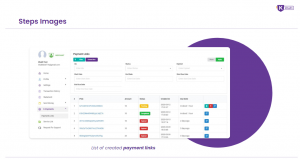

- List of created payment links

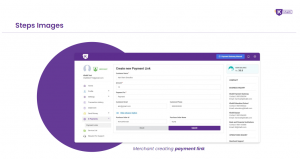

2. Merchant creating payment link

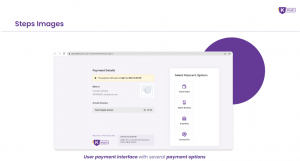

3. User payment interface with several payment options

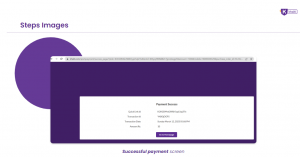

4. Successful payment screen

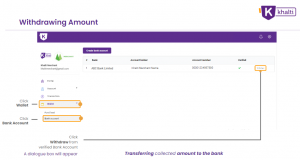

5. Transferring collected amount to bank

So why wait? Sign up for Khalti today and experience the power of QUICK LINK Payment. With just a few clicks, you can manage all your payments and enjoy more free time for the things that matter most. Try Khalti’s Quick Link Payment today and see the difference for yourself.

For more updates about Khalti’s campaign, events, services, and offers, you can also follow us on our official Facebook page, Youtube, Twitter, Viber, Linkedin, and Instagram.