Nepal Rastra Bank (NRB), the central bank of Nepal has issued a new directive imposing ceilings on digital transactions in Nepal. Deputy governor of Nepal Rastra Bank, Chintamani Siwakoti informed that new regulations have been brought in considering all sectors concerned and international norms. The new regulations will systematize digital payments in Nepal, he said. [UPDATE: NRB has raised transaction limits on digital banking and payments.]

What is in the new directive on digital transactions in Nepal?

As per the latest directive from Nepal Rastra Bank:

1. Banks and financial institutions are allowed to issue pre-paid card facilities of up to Rs 100,000 at one time, and users of pre-paid cards may withdraw Rs 500 to Rs 25,000 in one transaction and up to Rs 50,000 per month.

2. Debit card users can withdraw a minimum of Rs 500 to the maximum of Rs 25,000 at a time, up to Rs 100,000 in a day, and a total of 4 transactions in a day.

3. Credit card users will be allowed to withdraw cash only up to 10 percent of the credit limit. However, credit cards cannot be used for cash transactions.

4. Using Mobile Banking, you can make payments of up to Rs 50,000 in a day and Rs 100,000 in a month.

5. Similarly, using internet banking, you will be able to make payments of up to Rs 10,00,000 in a day and Rs 30,00,000 in a month. Also, you can make the transfer of Rs 10,00,000 at a time and up to Rs 50,00,000 funds in a month using internet banking.

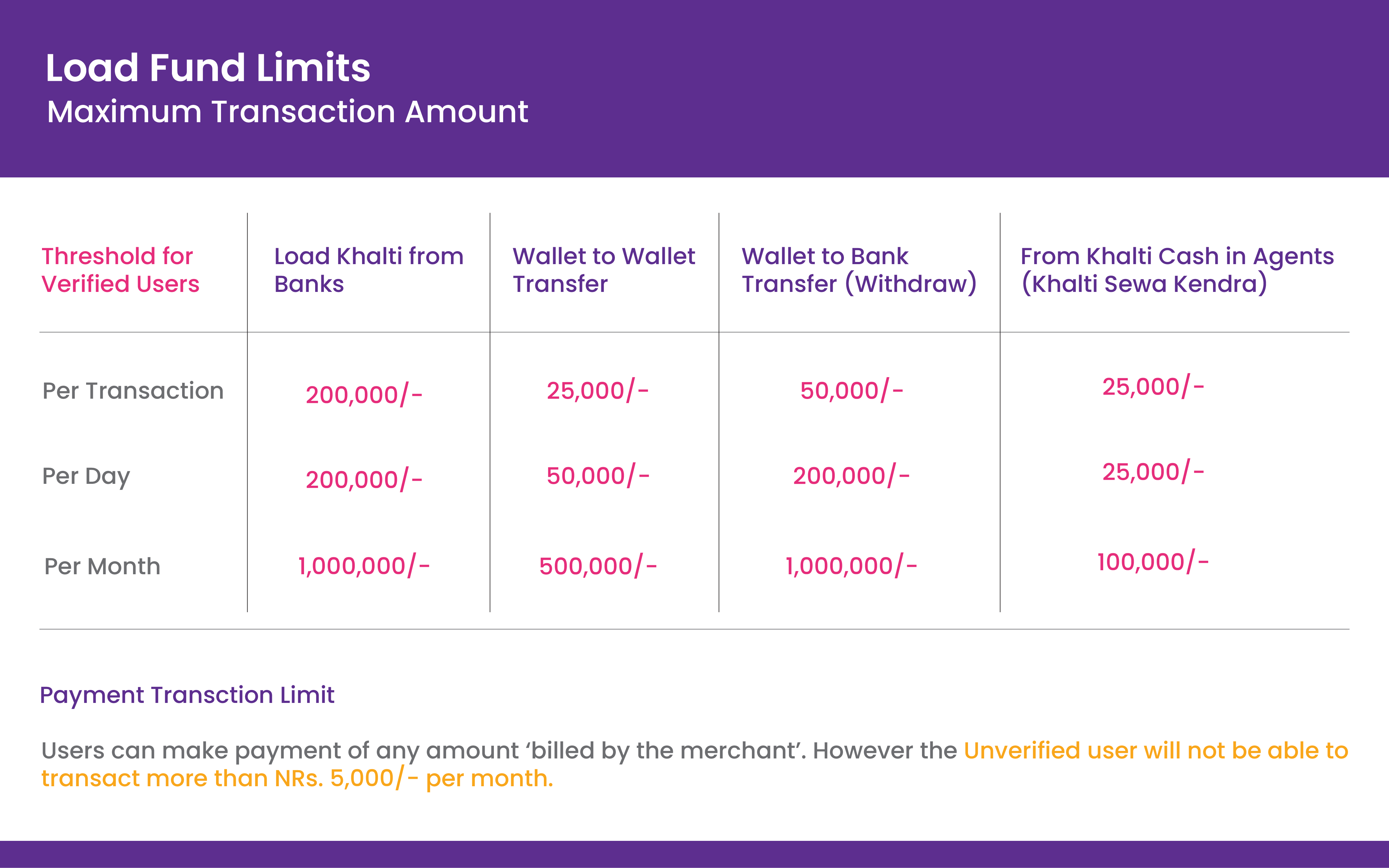

6. Likewise, using digital wallets like Khalti, you will be able to able to make payments of up to Rs 25,000 a day and Rs 50,000 in a month. You can top-up up to Rs 5,000 at a time, Rs 25,000 in a day, and Rs 50,000 from Agents and Sub-Agents (eg. Khalti Pasal), and make transactions in the same volume.

7. You can transfer an amount ranging from Rs 100 to Rs 5,000 at a time to your digital wallet from your bank account, and up to Rs 25,000 in a day. Your wallet cannot hold more than Rs 50,000 at a time.

Note: It mandatory for all users to fill up the KYC (Know Your Customer) form to carry out transactions above Rs 5,000. As digital wallet is a new technology in Nepal, no such limitations were imposed earlier.

The proposal to limit online banking transactions in Nepal was floated in a draft circular in December 2017. The NRB has now come out with final guidelines and sought to make strict rules for banks and mobile wallet operators.

Limits on the digital transaction in Nepal

| Method of Transaction | Transaction Limit at a time | Daily Limit | Monthly Limit |

| Digital Wallet (eg. Khalti) | Rs5,000 | Rs25,000 | Rs50,000 |

| Mobile Banking & QR Code Payment | Rs5,000 | Rs50,000 | Rs100,000 |

| Internet Banking (Merchant Payment) | Rs10,00,000 | Rs30,00,000 | |

| Debit, Prepaid Cards (Withdraw or Payment) | Rs25,000 | Rs100,000 | |

| Kiosk Machines | Rs5,000 | Rs25,000 | Rs50,000 |

What might be the impacts of this regulation on digital transactions in Nepal?

The volume of mobile banking transactions is showing an uptrend in Nepal and similar is the case for payments using digital wallets. Digital Payments is slowly starting to become a habit, especially among the young population.

However, the new restrictions imposed on internet banking and mobile wallets are sure to directly impact online payment and e-commerce growth in Nepal.

Compared to developed countries and our own neighbours like India and China, online banking and digital payments services in Nepal still have a long way to go. As per the latest data from Nepal Rastra Bank, nearly 65 lakh Nepalis use mobile banking and 8.5 lakhs use internet banking. And, it has been estimated that around 15 lakh people use digital wallets in Nepal like Khalti. However, growth potential is immense and this number is expected to grow exponentially.

Digital transaction in Nepal should be made safer, not imposed with such restrictions.

Digital wallets are largely viewed as a preferred mode of fund transfer for small value and to promote digital transactions in Nepal among people who cannot easily open a bank account, especially those in rural areas.

Mainly a cash-based economy, this new regulation might discourage the growth of digital transactions in Nepal, which is still at a nascent stage. There are fears, people will opt for cash for higher transactions. It will surely impact the digital and cashless Nepal dream. Many people have expressed concern over new NRB regulations. They feel it will discourage electronic payments in Nepal, and promote usage of cash.

If you prefer electronic money over cold cash, is this new regulation a welcome move? What might be its impact on the cashless mission of Nepal? Should NRB revise the directive?

![NRB sets limits on digital transaction in Nepal [UPDATE: NRB raises limit]](https://blog.khalti.com/wp-content/uploads/2018/04/NRB_11zon-1080x675.jpeg)