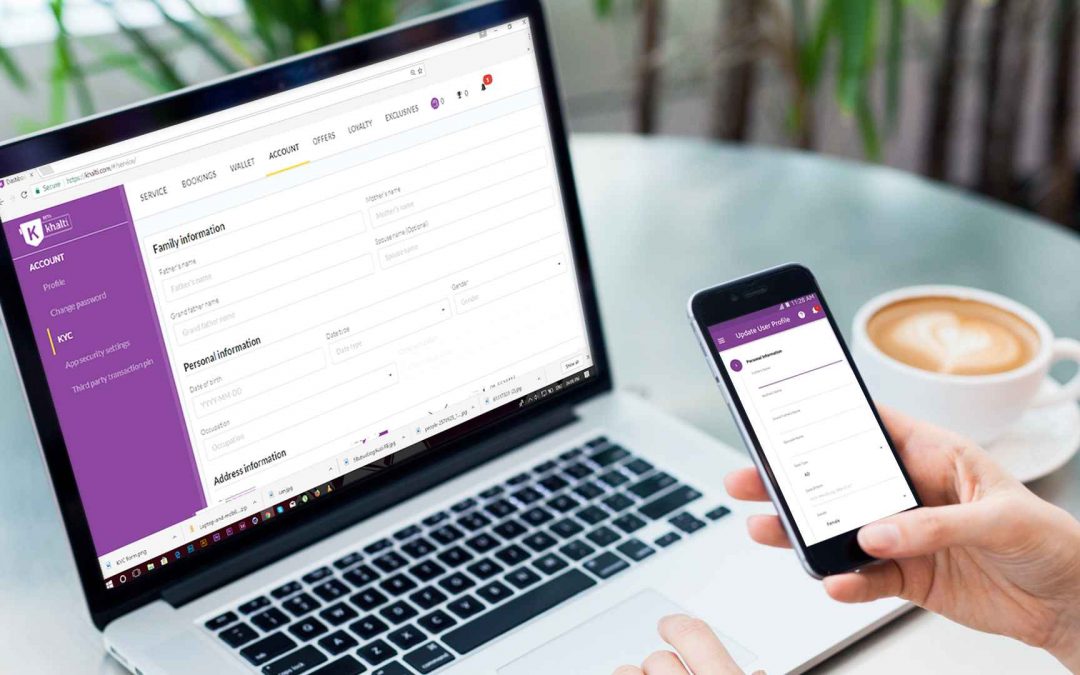

Are you a Khalti user and want to unlock the gateway to a wide range of offers, services & cashbacks? Verify your KYC Form within 2 minutes and experience the secure and hassle free transaction along with these benefits:-

- Payment above Rs. 5000

- Send Money to 60+ Banks

- Bank Link Payment services

- Send & Receive remittance

- Enjoy cashback & offers

Why is KYC Verification mandatory?

The NRB has mandated the KYC verification for transactions exceeding Rs 5,000/- in order to increase the security of digital transactions. As you are all aware, Khalti operates in accordance with NRB regulations as well and adheres to them for the users’ proper security.

Steps To Verify KYC

Step 1: Access the KYC Details Section

Open the Khalti app and navigate to your profile. Access the KYC details section.

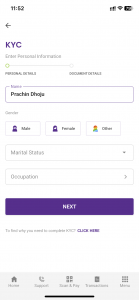

Step 2: Enter Personal Information

Enter your accurate personal information and proceed by selecting “Next.”

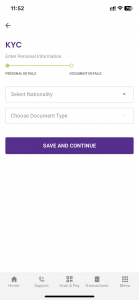

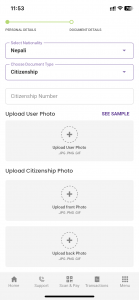

Step 3: Select Nationality and Document Type

Choose your nationality and the type of document. Click “Save and Continue.”

Step 4: Provide Document Details and Photos

Enter your document number and upload required images. Include your user photo, as well as clear front and back images of the original document (formats: *.JPG, *.PNG, *.GIF).

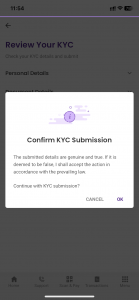

Step 5: Review and Submit KYC Form

Review all details and select “Submit KYC” upon confirmation.

Step 6: Confirm KYC Submission

Confirm your KYC Form submission as prompted.

Don’t have Khalti? Download now

For more updates about Khalti’s campaign, events, services, and offers, you can also follow us on our official Facebook page, YouTube, Twitter, Viber, Linkedin, and Instagram.