Want to take full benefits of all the Khalti services? So why not clear out all the questions in your head and be a KYC-verified user for exclusive cashback offers and hassle-free services.

To increase the security of digital transactions, the Nepal Rastra Bank made it mandatory for all digital wallets operating under NRB guidelines to comply with KYC norms in Nepal. This means that Khalti falls under NRB guidelines and per the guidelines, if you want to make a transaction above Rs 5000 being a KYC verified user is a must.

What is KYC?

The procedure of Knowing Your Customer otherwise referred to as KYC is a standard set of documents that allows the verification of the identity of the person. Such documents enable us to get detailed information about the customers, protecting both parties in the transactions and relationships.

What are the benefits of being a KYC-verified user?

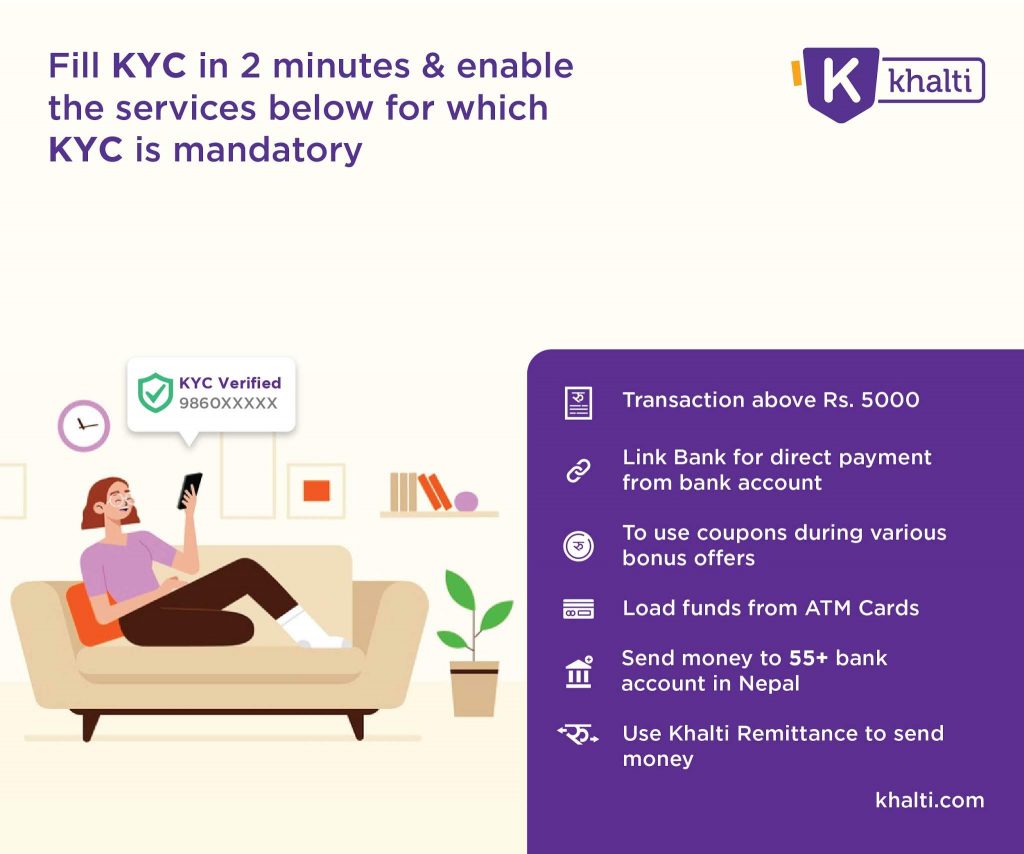

Being a KYC-verified user lets you use all the available services in Khalti. If you haven’t upgraded your Khalti account to a KYC-verified account with a green tick, you can only do transactions up to Rs 5000 one time in a month. This is the limitation many non-verified users have to face, so that is why it is important to be a verified user. The benefits of being a verified user are:

Easy bank transfer:

Once your Khalti account is KYC verified, you can transfer your money to a 60+ bank account in Nepal. You will be able to transfer the money to any bank account, yours, or someone else’s.

Bank Link:

Bank link is a hassle-free feature that allows you to do all the transactions from the linked bank account. All you have to do is link your bank a/c number to Khalti and you are all set to pay directly from your bank balance. Once you link your bank account to Khalti you will be eligible to load funds directly from the bank account and avail of all the services in Khalti. For now, the bank link service is available for only NIC Asia but more banks will be added soon. So simply complete your KYC and link your bank account for smooth transactions.

Khalti Remittance:

With the Khalti remittance feature, all the Khalti users can easily transfer money using Khalti to their family, friends, and relatives across the country with just a tap from their mobile phones. This feature is very easy which lets you find the convenient location of the partnered agents across the country and also check the remit status of the money you sent. After the transfer, the automatically generated pin will be sent to the receiver’s mobile phone which he/she needs to show to the specific agent to collect the money. The available Khalti-partnered agents are

- City Express

- Nepal Remit

- Bhatbhateni Money transfer

- World Remit

- And many others

But to be able to use this service you need to be a mandatory KYC verified user.

Load funds from ATM card:

If you have an ATM card in your purse, you can use it to load funds into your Khalti wallet. All you need to enter the detail asked and your money will be loaded instantly. Having said that KYC verification is a mandatory requirement for this service as well.

Use coupons during various bonus offers:

After being a KYC-verified user you will be able to use coupons which include cashback and bonus offers that Khalti has to offer without any worry of transaction limit.

Transactions above Rs 5000:

As mentioned already as per the guidelines of NRB to be able to do transactions above Rs 5000 in a digital wallet you need to be a KYC-verified user.

Do I Need to Pay for KYC?

No, KYC is absolutely free. You are not charged any amount to be a KYC-verified user. Rather our KYC team will be always there to assist you in completing your KYC form.

Is the KYC Process Safe?

The question is absolutely understandable as security is the top concern of any user and ours as well. So we want to let our users know that the KYC process is absolutely safe and the documents you upload will be stored securely. Furthermore, the KYC process is handled by our trained and authorized representative, and all the photos plus documents are transferred securely to our servers, not to the personal devices of our representatives.

Can you fill out your KYC form from Home?

Yes, absolutely you can easily fill out your KYC form from your home, and once completed our KYC department will verify it within 1 to 2 days after submitting the KYC with all the appropriate information.

To know the process of filling up your KYC, the required documents needed and for verification go to the link for more details:

Here are some common reasons why KYC may be rejected:

- The photo you submitted might not be clear

- The document you Submitted might be incomplete and does not meet specified requirements.

- Expired documents

- Mismatched Signatures

- For users who do not meet the age requirements, the KYC process may be rejected.

- False information, the documents you submit might not match the information you filled

To Know more watch the video below:

Don’t have Khalti? Download now

For more updates about Khalti’s campaign, events, services, and offers, you can also follow us on our official Facebook page, YouTube, Twitter, Viber, Linkedin, and Instagram.