Tired of standing in long queues at your local municipality tax office? If so, it is probably time for you to go digital. All it would take you is a few minutes! Just use the Khalti Digital Wallet App for online Inland Revenue tax payments in Nepal, and make your payments in a jiffy.

How to Make Inland Revenue Tax Payment Online in Nepal Using Khalti

All you have to do is follow these simple steps:

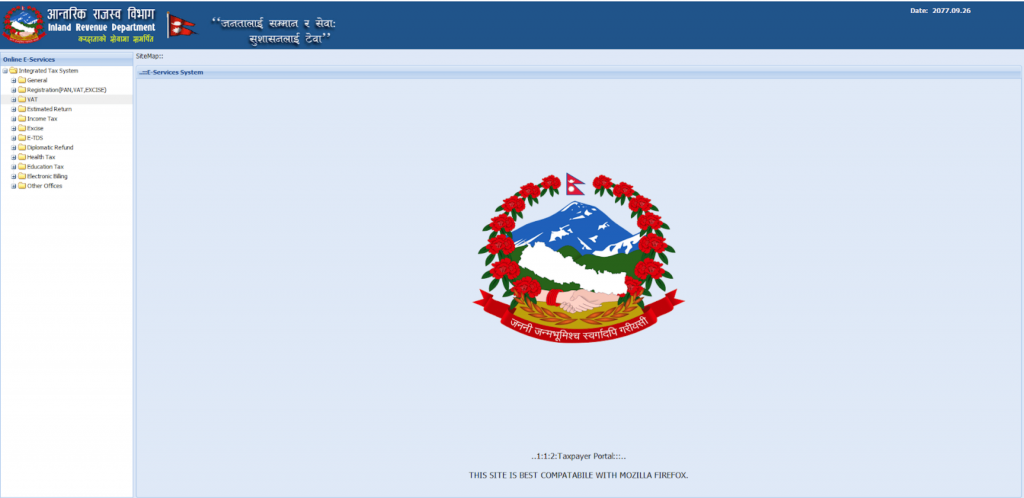

- Go to Inland Revenue Department official website

- Click on ‘Tax Payer Portal’

- Expand “General” and click on ‘Tax Payer Login’. You will see the taxpayer login dashboard.

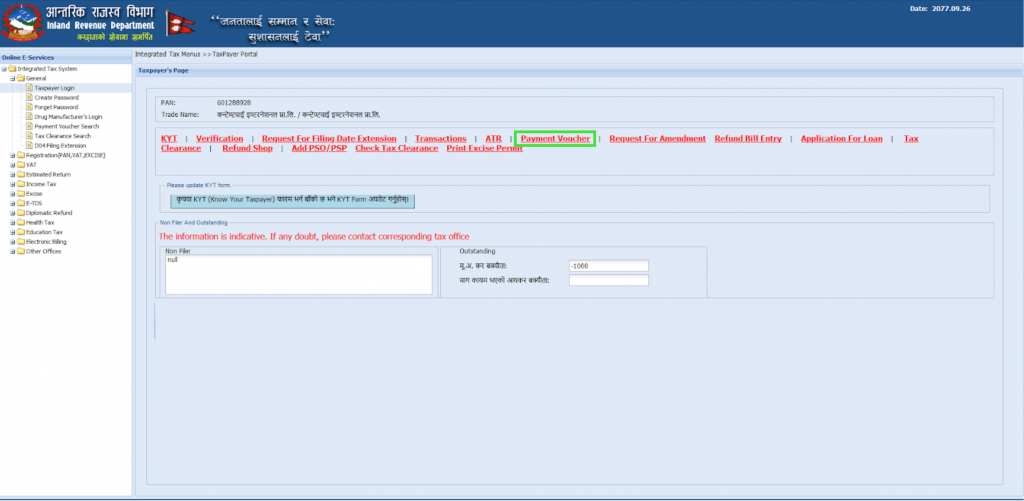

- Enter your business PAN Number, username, and password to proceed further.

- Click on ‘Payment Voucher’

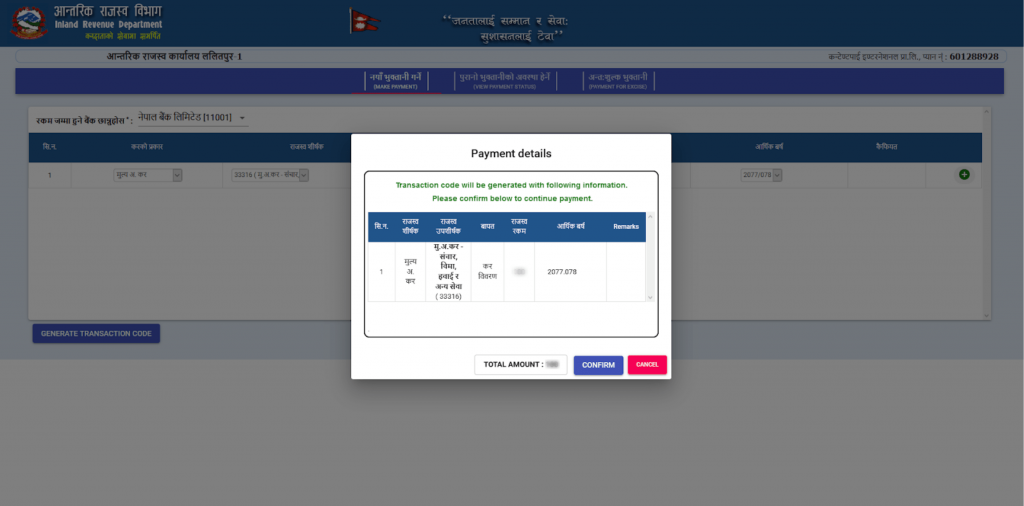

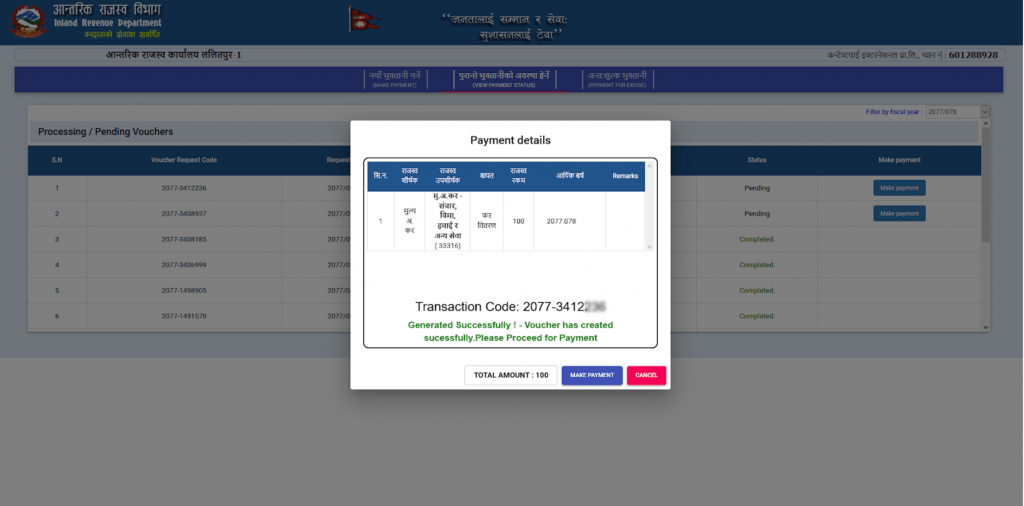

- Choose ‘Nepal Bank Limited’ as your preferred bank, type of revenue you want to file (one from income tax, value-added, tax, or excise duties), and revenue title. Similarly, select year of income, and click on ‘Generate Transaction Code’

- Re-check the payment details and click on ‘Confirm’

- Copy the Transaction Code, go to Khalti’s official website or the Khalti app

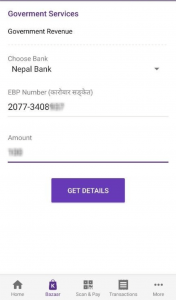

- Scroll down to the ‘Government Services’ section, and tap on ‘FCGO’

- Paste your Transaction Code under EBP Number, enter the amount, and tap on ‘Get Details’

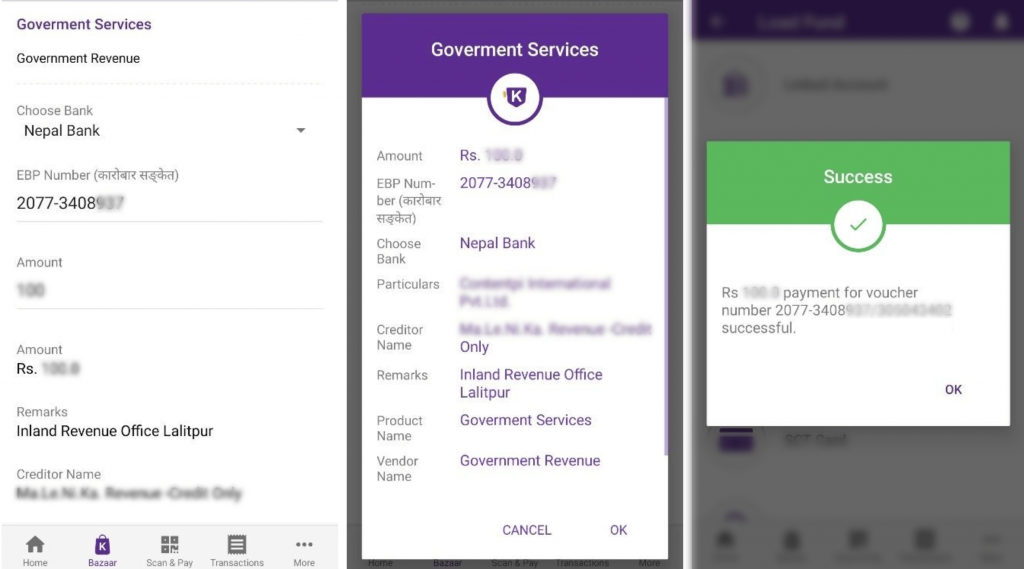

- Re-check the details and tap on ‘Check Out’ to complete the payment process

With these simple steps, you will be able to pay Inland Revenue Tax within few minutes.