Digital transformation is disrupting the payments space! Mobile payment in Nepal is set to soar in 2075!!

The mobile payment method in Nepal has seen a sharp rise in the past year. 2075 BS is going to be an exciting year. Social media usage and internet marketing is growing rapidly. Today the business world is in the midst of a digital transformation. Mobile payments have quickly evolved over the past few years in Nepal, with more and more recognizable brands and promising startups stepping into the industry to improve technology and deliver what businesses and consumers want from services and apps that let them pay using their phones.

2074 has been quite impressive with lots of innovations and technology upsurge. There has been a significant increase in web-based transactions and mobile transactions. The rapid development of mobile technology is expected to take the mobile payment landscape in Nepal to the next level this year. It is the right time for businesses too to implement mobile payment methods as more and more people have started using them.

We are talking about smart cities, digital Nepal, and e-governance. The development of the mobile payment ecosystem is definitely a pre-requisite to making Nepal digital. Mobile payment is not a luxury, but a necessity. It makes our lives convenient as we no longer need to carry cash.

Mobile payment can be a revolutionary transforming force for cashless Nepal if the existing and emerging payment service providers can exploit the potential to the fullest.

Banking penetration in Nepal is just 60% while mobile penetration is whopping 135% and internet penetration is 63.81%, and there is increasing advancement in telecommunication technology. Thus, mobile payment has great potential for expansion. And, there is an opportunity to bring a large portion of the unbanked population into digital finance. It can ultimately contribute to strengthening the financial inclusion of people in remote areas where they previously had no such access to formal financial services.

Digital Finance System (DFS) can ensure transparency, reduce fiduciary risks, foster good governance, and improve service delivery. The government should be mandating the use of digital payments by the government (for social protection payments) and salary transfers to its employees via DFS, instead of the traditional way of cash payment. Like in India, government employees in Nepal too should be encouraged to make e-payment of electricity, water, and telephone bills to promote digitization. Furthermore, government employees who received their salaries in bank accounts should be encouraged to avail themselves of digital financial services instead of cashing out.

M-Pesa, Kenya’s mobile payment service provider is talked about globally for its works. We too can grow Nepali digital wallets on a similar scale and help them lead by example.

Why be optimistic about 2075?

Nepal has gone into a federal system of governance. New governments have been formed at both the central and local levels. Yubaraj Khatiwada, former governor of Nepal Rastra Bank and an economist, has been appointed as the Minister of Finance. He has declared to bring significant changes in the payment system in Nepal. The government has announced to take the work of tax collection digital. We can consider this as a revolution in the coming!

It was just last year Nepal Electricity Authority introduced online bill payment. We can read the news that a significant portion of the population has stopped going to NEA bill payment counters. They simply pay from the comfort of their home. Similar news on transformations brought about by technology will be a norm this year.

The growing cell phone penetration rates, cheaper handsets, better technology, interest from financial institutions and mobile network operators is a boon for the growth of the mobile payment ecosystem in Nepal.

Mobile payments’ contribution in cash’s decline would be probably visible this year. Confidence among consumers will also rise as mobile wallets introduce more and more services and grow in size.

Mobile payment space booming in Nepal

The way people make payments is changing in Nepal, and there is an exponential growth in digital wallet users.

Currently, a total of 14 payment service providers have already received a Letter of Intent (LoI) from Nepal Rastra Bank to operate payment service providers and have already introduced their service in the market. As many as 103 more payment service providers are expected to get you to operate digital wallets this year.

The government should also wake up to take formal finance to the rural population. Instead of opening a brick-and-mortar branch, banks need to think differently and start focusing on digital banking via mobile or the internet. It is challenging in the beginning, but it’s a cost-effective way in the long run. At the present age, digital finance is the only means of providing and ensuring reliable and affordable financial services to all segments of society.

Cashless transaction to become trendy

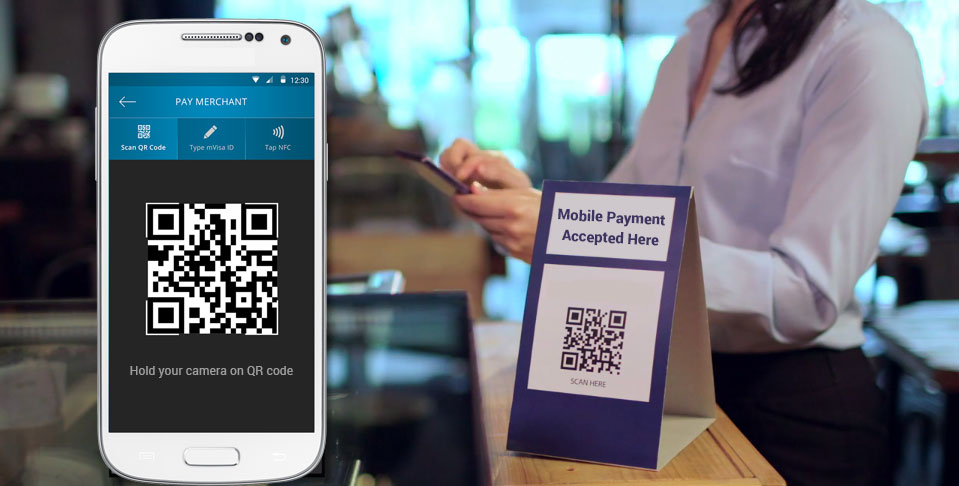

Performing cashless and paperless transactions through mobile has become a trendy and convenient method of payment.

More and more services can be expected to be available for payments via mobile wallets. Even in normal brick-and-mortar store purchases, ‘Scan and Pay’ is expected to be used massively. The volume of mobile-mobile payments will be larger.

The number of people using mobiles for payments is merely 1 million (as per the latest download no. of mobile wallet operators in Nepal). This number should be growing massively this year, and more and more people would be using mobile payment in Nepal more actively.

E-commerce sites accepting digital payments

Currently, Cash on Delivery (CoD) comprises a big chunk of e-commerce payments in Nepal. However, it is projected to slow down, and digital payment is to take the charge. Daraz, Sastodeal, FoodMandu, MetroTarkari, etc. and most other big e-commerce sites have already started taking online payments.

Fintech space one of the fastest-growing app categories

Khalti Digital Wallet trended in Number 1 spot in Google Playstore for over two weeks, for the first time in the history of Nepalese payment app. Likewise, eSewa’s Android app alone has crossed 500,000 downloads. It was also honored by Nepal Telecom for selling recharge cards worth the maximum amount amongst all distributors of recharge cards. Apps of digital wallets are probably the most downloaded apps in Nepal after social media apps, mobile games, and news apps. Many promising payment gateways and mobile wallets are emerging. This growth of mobile wallets is projected to escalate as the population becomes more financially literate and feels the necessity, importance, and convenience of mobile payments.

NRB introducing National Payment Gateway in Nepal

The central bank is expected to introduce a national payment gateway in a bid to monitor digital payment systems and transactions in Nepal. VAT, income tax, and excise duty payments can be made digitally, once the service comes into operation.

Similarly, NRB has started preparing laws to regulate digital payment systems.

Nepal Telecom coming up with a mobile payment service?

Nepal Telecom, a state-run and largest telecommunication service provider in Nepal is expected to launch a mobile wallet possibly this year.

Since it already has a large customer base, it can easily provide digital payment services to many.

International Payment Gateways entering Nepal?

There are rumors that Paypal, one of the most well-known brands in the fintech space and top influencer in the payments industry is eying the Nepali market. Let’s wait and see if it turns real.

Cashless Society Dream to come true?

Cash might not be dead anytime soon, but the world of digital payments — both from consumers to businesses and between businesses — is evolving faster than ever before.

Most of us are aware of the M-Pesa mobile payment app’s popularity in Kenya, and how it set an example all across the world. In Kenya, before M-Pesa came, many people in rural towns and villages were without bank accounts and solely reliant on cash. Present Nepal too looks like pre-MPesa Kenya. With the collective effort of everyone, cashless Nepal is not a distant dream. However, user awareness is very essential.

Fundamental shifts in consumer behavior, the emergence of new technologies, and an evolving regulatory landscape mean the payments ecosystem is poised for unprecedented transformation in 2075 BS. The demand for safer data, faster payments, and better experiences present a great opportunity, but also significant challenges.

In a nutshell, 2075 is going to be an exciting year as more operators come to the field. However, instead of competing in the (almost) already saturated urban market, they need to shift focus to the unbanked population. We are nowhere if we compare our neighbors India and China. Mobile and digital payment methods are still in their infancy here. Our success lies in tapping the unbanked population. Let’s hope for the best, and let’s start using mobile phones to make payments.

Thanks a lot for this post.