We built Khalti brick by brick, step by step, effort upon effort, faith upon faith, and your blessings upon your blessings. Here, we share with you the Khalti Story and our journey.

The world was slowly going digital, and mobile payment was becoming part of people’s lifestyles.

In contrast, Nepal seemed to remain untouched by the emerging technological development. There was no policy in place. Though we planned to start a mobile-payment platform around at 2010, we could not start the project as there was no clear policy for online payments in Nepal. Added to this, we were not sure if online payment can run well in Nepal, or if it’s too early for the market. Technology was just emerging and smartphones were just coming. Thus, we decided to put the idea on hold.

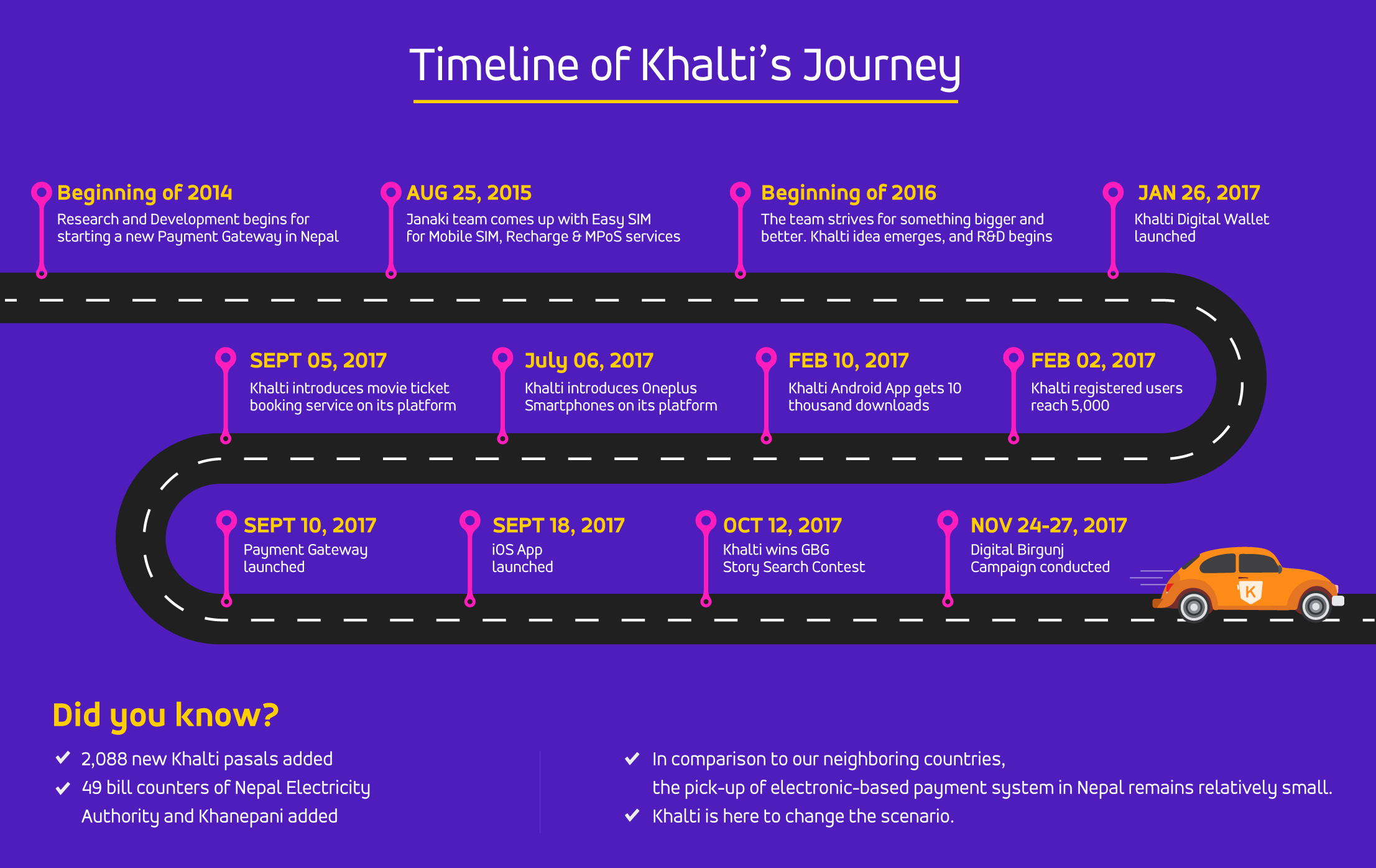

Team Janaki Technology started to work towards our flagship service, Sparrow SMS, even with much vigor. The Picovico idea emerged around the same time. On 1 August 2014, we started to research and development on financial technology and starting an online payment gateway in Nepal. We went to India, the USA, and Chile where we got to witness the FinTech ecosystem more closely. In India and China, PayTM and Alipay were doing quite well. People had stopped going to shops to buy recharge cards. They had stopped going to the railway station to buy train tickets. Instead, they would carry out such works online. The method of payment was slowly changing in India, and it was getting more interesting seeing the market there. We were also closely following how Alipay was rapidly expanding all over China.

Developing EASY SIM

Around the beginning of 2015, we took the dealership of Nepal Telecom SIM cards. The dealership was about supplying SIM cards to dealers in Kathmandu valley and activating the SIM.

At that time, our dealers also used to ask us if it was possible to have mobile recharge services in an easier way. We then thought of developing EASY SIM, a B2B system to provide NTC SIM card dealers with online recharge services. Around the same time, demonetization happened in India and PayTM and other payment service providers saw an accelerating growth. Nepal Rastra Bank too brought the first draft of the policy on the online payment systems. Similar multiple things that happened around the time pushed us to start a digital wallet, and later a payment gateway at large.

EASY SIM => Khalti: A Transformation

Though we were quite occupied with Sparrow SMS and Picovico as both were in the expansion phase, we knew that the consumer base of these two products overlaps with the to-be-launched digital wallet service. As we were already working with Telecos, ISPs, Banks, and various other organizations in Nepal for SMS and the user segment was overlapped, we were tempted to introduce a digital payment system in Nepal.

Though the payment industry was taking a huge leap across the world, the digital payment ecosystem was yet to see sunshine in Nepal. Though big players were already in the market with a wonderful brand reputation, the potential market was unexplored. And, we felt it was high time to bring disruption in the payment industry.

There was almost no substantial growth of digital payment in Nepal at a time when our neighboring countries, China and India, were taking a huge leap in the payment gateway. Through Khalti, we tried to understand the pain point of users and solve them. We were sure, people will use our products if they find it good and helpful.

Almost none in Nepal had imagined that they could pay for a cup of tea with from their mobile phone. And, here we are, striving to bring this dream into reality.

Team Khalti Story: Working towards transformation

We had found the NRB’s policy vague and lengthy at first, but the officials there were very supportive. I myself had come taking an extensive training about Certified Payment Card Industry Security Implementer (CPISI) from abroad. We had already known what we needed to know before finally working on the development of a payment gateway. We had done a lot of homework before deciding to work on the project.

Then began the most challenging part, working on designing and developing the system. Our first priority was ‘best user experience. Since digital payment is such a solution that people still fear to use, and if the user experience is not that good, people won’t use it at all. Added to this, it also needs to be fully automated. In case a transaction fails, the clients would be getting payment returned back to their account within 30 seconds. This phase of development was the most challenging of all.

We made the app adopting the latest technology in the industry and the best platforms. Technology-wise, we made the platform very competent. The founders themselves were directly involved in the designing and development of the architecture of Khalti. We had prepared a master plan on how to make each and every step and functionality in the app. The army of the team worked day and night tirelessly. We had that passion to bring our dream project to the market. We built Khalti brick by brick, and step by step.

After a lot of hard work and on-the-ground research, we finally launched Khalti Digital Wallet on January 26, 2017.

Khalti is not just a digital wallet, it’s an entire payment ecosystem. In Khalti, you can find multiple things ranging from Scan and Pay to Person to Person Payment to accepting Third-Party Payment among other modes of payment.

Naming the company ‘Khalti’ was an interesting incidence. We wanted a traditional Nepali word which could represent Nepal. And ‘Khalti’ was such a name to which everybody was agreeing as it seems native and synonymous to wallet, where we put money. Also we didn’t want to put any prefix like ekhalti , mkhalti, hamrokhalti, merokhalti, or postfix like khaltipay, etc.

We have future plans to take khalti global and we will be proud to represent ourselves with a local Nepali word and create a stamp of the same in global arena.

And, Khalti went viral

To warm up the people before the Khalti app was formally released in the market, we had made a teaser on how physical wallets and hard cash are going obsolete. To our surprise, the video went viral and was viewed by as many as 1 million people. The video was very well received, and we got wonderful feedback from people for Khalti.

‘We are optimistic’

Hard cash still holds the major form of payment in Nepal, and the digital payment system is still in its infancy. We feel uneasy if we don’t carry cash in our pocket. Hard cash still gives us more confidence.

Until and unless we don’t get into the lifestyles of users, the digital payment ecosystem won’t grow through mobile recharge services alone.

But, slowly, payments of government bills are coming online, from electricity and water bill payments to taxation and other fees. Many people have started to use online payment gateways to pay utility bills. It’s hassle-free paying bills online, compared to being physically present at the payment counters and wait for hours in a long queue.

Our ultimate dream is to see people loading all of their salaries to Khalti, and making all types of payments, from house rent, groceries, bus fare, to tea shops and everything via Khalti. Our dream is to see people using smartphones for all types of payments, and make hard cash obsolete in Nepal.

Tracking one’s expenditures and developing their financial capacity

One of our major problems is, we don’t know about our real spending habits. If we’re making all the payments in digital form, we can track our expenditures, and at the end of the month, know how much we spent and for what purpose. Even a shopkeeper can track his sales in real-time, and the money automatically gets deposited into the bank account. An interesting era is beginning.

As per the recent UNCDF report (July 2016), only 61% of the adult population has access to formal finance in Nepal. What’s more? The number of users paying through the digital wallet is peanuts compared to smartphone users in Nepal. This gave us confidence that there is a huge potential for digital wallets in Nepal, no matter how challenging it might be. A transformation is happening slowly on people’s payment habits, from hard cash to cheque and ATM cards, and recently, through digital wallets.

Building an e-payment ecosystem

But, the most challenging of all is User Education. Until and unless people are digitally aware of the digital payment system in detail, it’s hard to sell our products. One cannot build up an ecosystem alone, and there should be multiple players to build the ecosystem. If all the digital payment service providers go collectively, it will help build the ecosystem with ease. We have always taken other FinTech companies in Nepal as collaborators rather than competitors.

We are also working in close collaboration with various schools, colleges, and communities. #DigitalBirgunj was one of the mega-events Khalti collaborated on for digital awareness. At the event, we conducted training for as many as 200 homemakers and local clubs including the Community Police Center.

We are eyeing not only the big transactions but even the smallest transactions on our payment platform. We dream to see students using Khalti to pay in the school canteen. It will ultimately drive the ecosystem. It might look like a matter of too small significance now, but it’ll have a great impact.

In the duration of the next two to five years, we are sure the majority of people using the digital method of payment.

Khalti’s journey to GBG and winning the global competition

Hundreds of companies across the world had applied for the international competition, Google Business Group Storytelling Contest, and it was the fiercest competition we have been to so far. A total of 24 startups were shortlisted in the preliminary round where all of the startups looked equally promising. Each of these startups had to go for the second round of judging and all had to shoot a 1-minute video and submit it. Again, in the semi-final round, we were selected among the top 9 companies. As we saw the names of other finalists in the competition, all the companies looked really wonderful.

On 12 October 2017, winners were announced for the competition, and Khalti was selected among the four winners. That time we felt we had done something significant by starting Khalti and represent Nepal globally. For us, winning the competition was like google endorsing our ideas and saying that digital wallet and e-payment are essential even in countries like Nepal.

Nepal, though popular in tourism and other sectors, has not been able to leave its mark on the technology sector. We want to give a message to the world that though crushed in between two giants China and India, we are doing some innovative works in technology. Google is such a big platform, and the world will know how technology is evolving in Nepal once Google releases the special video it made on Khalti’s story in January 2018. It will be not only a matter of pride for Khalti as a company but also a proud moment for all the Nepalese. The Khalti story in the video on how we are changing the payment landscape of Nepal will surely touch everyone’s heart. We are very much excited about this.

People in Nepal are slowly adopting the technology, thanks to Facebook, Viber, and other social media tools. Thus, there remains a huge opportunity for us, and we are confident to tap this.

Being prepared to take all the challenges lying ahead

The biggest challenge for us is, neither banks have reached villages nor there are ATMs. If people have to take money from banks, they have to visit the nearest town. If we make the village digital, and make people conduct transactions from digital wallets, banks not necessarily need to be there, and it will even more effective medium than banks. A digital wallet can play a crucial role in rural parts of Nepal. For example, farmers’ earnings will deposit on their mobile wallets, and they can use the platform to pay for goods and services, ultimately removing the necessity of hard cash.

The government has brought a policy to make smart villages. Digital payment will take the government’s digital drive to the next level. If this happens, even NRB will be free of all the hassles relating to printing the hard cash.

However, digital wallets are not banks or competitors of banks. And, users will have their money on banks. We are just medium for the users, and facilitators for the banks. Wallets will only have some small amount of money and we are here just to facilitate payments. Like loading the money from bank to wallet, they can also transfer money from wallet to bank. Loading the money in your wallet not necessarily means that you have to spend the money anyhow, you can also transfer it back to your bank account.

What to look at in the near future?

We had started Khalti with very few banks, and more and more banks are on their way to being associated with the Khalti platform.

We have got far more than what we had expected while launching the platform. Seeing the users’ response, we are very much excited and are actively working to bring even more services and facilities to our users.

The year 2017 was full of optimism and excitement. It was the year we took the biggest leap. Coming this far, we feel blessed to have got overwhelming support from all of you. Please bear with us as we take even bigger challenges and achieve more milestones in the days to come.

By Manish Modi

Co-Founder and Managing Director, Khalti Digital Wallet

This Khalti Story was first published at Medium on 27 December 2017. Read the original article here.