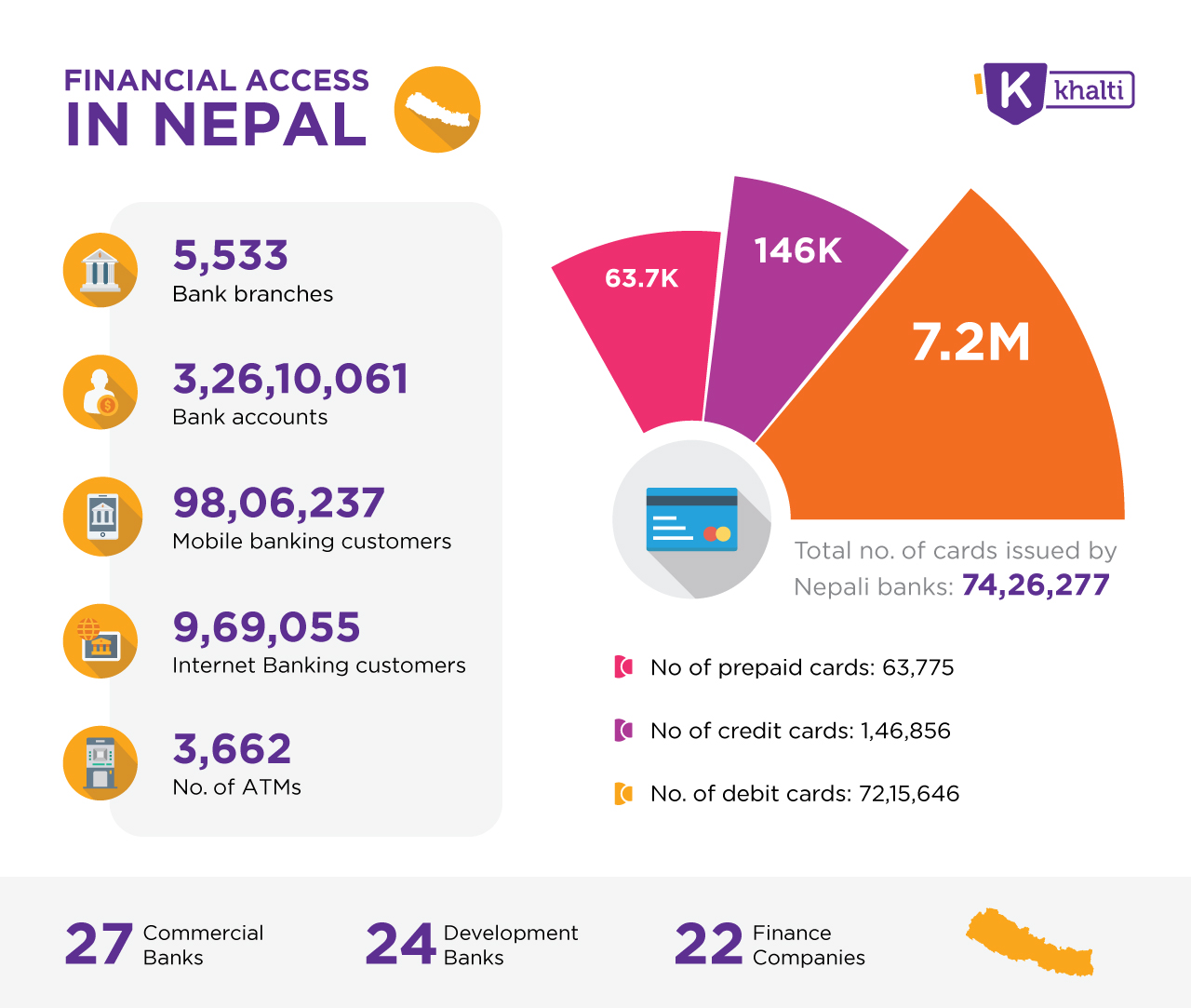

Nepal has seen a shift towards digital banking during the past few years. These days, more and more people are accessing banking services using mobile phones. As per the latest statistics from Nepal Rastra Bank, more than 9 million people use mobile banking in Nepal. The reason: mobile banking apps have simplified the way we conduct most of banking transactions.

The shift to mobile banking has been driven by a number of factors and events. Accessing banking services through mobile apps is very simple and convenient. Likewise, banks have also started placing more effort on mobile banking by improving security and convenience of their apps and enhancing the user experience. Furthermore, broader access to digital devices, and improving network connectivity has helped in the growth of mobile and internet banking in Nepal.

Mobile Banking in Nepal: Inception and the present status

In the case of Nepal, Laxmi Bank was the initiator of mobile banking. It started mobile (SMS) banking facility in 2004. Since then, there is a rise and rise of digital banking in Nepal. 9.8 million people have already registered for mobile banking.

What can you do with mobile banking?

With mobile banking app installed on your phone, you can literally do your banking from anywhere. Some of the facilities provided by mobile banking apps are:

1. View your account balances

2. Instant updates about your banking transactions

3. Transfer funds to bank account of your friends and family

4. Pay utility bills

5. Load digital wallets like Khalti and make cashless payments on the go

Download trend of Nepali mobile banking apps

Digital banking penetration is relatively lower in Nepal compared to other Asian countries. But, it is growing exponentially. The majority of the banks in Nepal have been providing mobile banking facilities to their users. Moreover, many of the commercial banks in Nepal (Class A banks) have their apps downloaded by over 100 thousand users. And this number is growing every other day.

Financial Inclusion through mobile banking?

The unbanked and underbanked population can be served easily through their mobile devices through mobile banking facilities. But, in Nepal, we can’t see that happening yet. The majority of mobile banking users in Nepal are from urban areas. Digital literacy and financial literacy are required to increase access to mobile banking in rural parts of Nepal.

As per the WorldBank’s Global Findex Database 2017, only 45% of the adult population in Nepal has a bank account. For 20% of the unbanked population, the reason for not having an account is: financial institutions being too far away. Mobile banking can be a tool to eliminate this barrier.

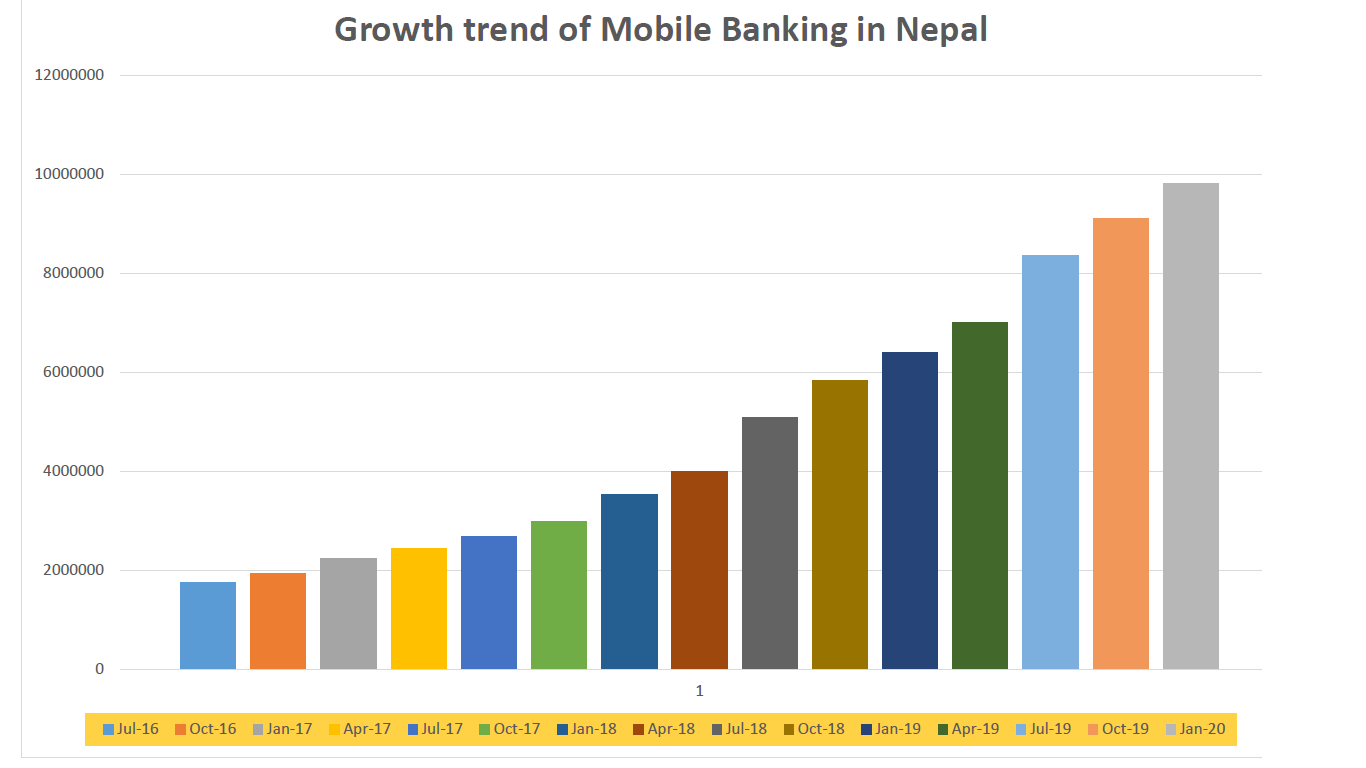

The graph below, prepared using statistics from Nepal Rastra Bank shows Nepal has recorded a steady growth rate of mobile banking users.

In a nutshell

Mobile banking is growing at an accelerating pace in Nepal. However, there are no recorded statistics about the volume of mobile banking transactions in Nepal. It is high time Nepal Rastra Bank starts recording statistics on the volume of mobile banking transactions on its monthly/quarterly/yearly reports on banking statistics.

The government has made already it possible it is possible to pay revenue and all forms of taxes from mobile phones. This shows mobile banking is the future of banking in Nepal.

More and more people are opting for mobile banking apps due to their accessibility and usefulness. Most importantly, from a bank’s economic point of view, servicing a client through mobile banking is highly cost-effective compared to servicing through branch banking.

Concerns over security issues and a lack of digital skills are the major barriers to the adoption of mobile banking in Nepal. If these issues are addressed, mobile banking will surely get a huge boost in the country.

Read also: How to open a bank account in Nepal and enable mobile and internet banking?