We are living in an electronic age. The vast majority of us own a smartphone. Online space in Nepal is in an increasing trend. Social media portals like Facebook, Twitter and Instagram are becoming more popular than ever. In a similar fashion, technology has also influenced the way we interact with banks. Internet banking/ebanking in Nepal is in an increasing trend as more and more people are starting to do transactions online.

What is Internet Banking/eBanking?

Internet banking/ebanking is an electronic payment system that enables customers of a bank or financial institution to conduct a range of financial transactions through the financial institution’s website. Using internet banking, you can obtain your account balances, a list of recent transactions, various utility bill payments, and funds transfers between a customer’s or another’s accounts. You can access all these facilities from anywhere and anytime using mobile or computer. It’s less time consuming, and very safe and secure.

Internet Banking in Nepal: The Inception

Kumari Bank was the initiator of internet banking in Nepal. It started its e-banking services in 2002. Since then, internet banking in Nepal has grown by leaps and bounds. Also, Nepali banks have become hugely proactive to promote internet banking and electronic payments.

In a country like Nepal having difficult topographical terrain, internet banking acts as an easy medium to reach out to the customers in the hinterlands.

Present scenario of internet banking in Nepal

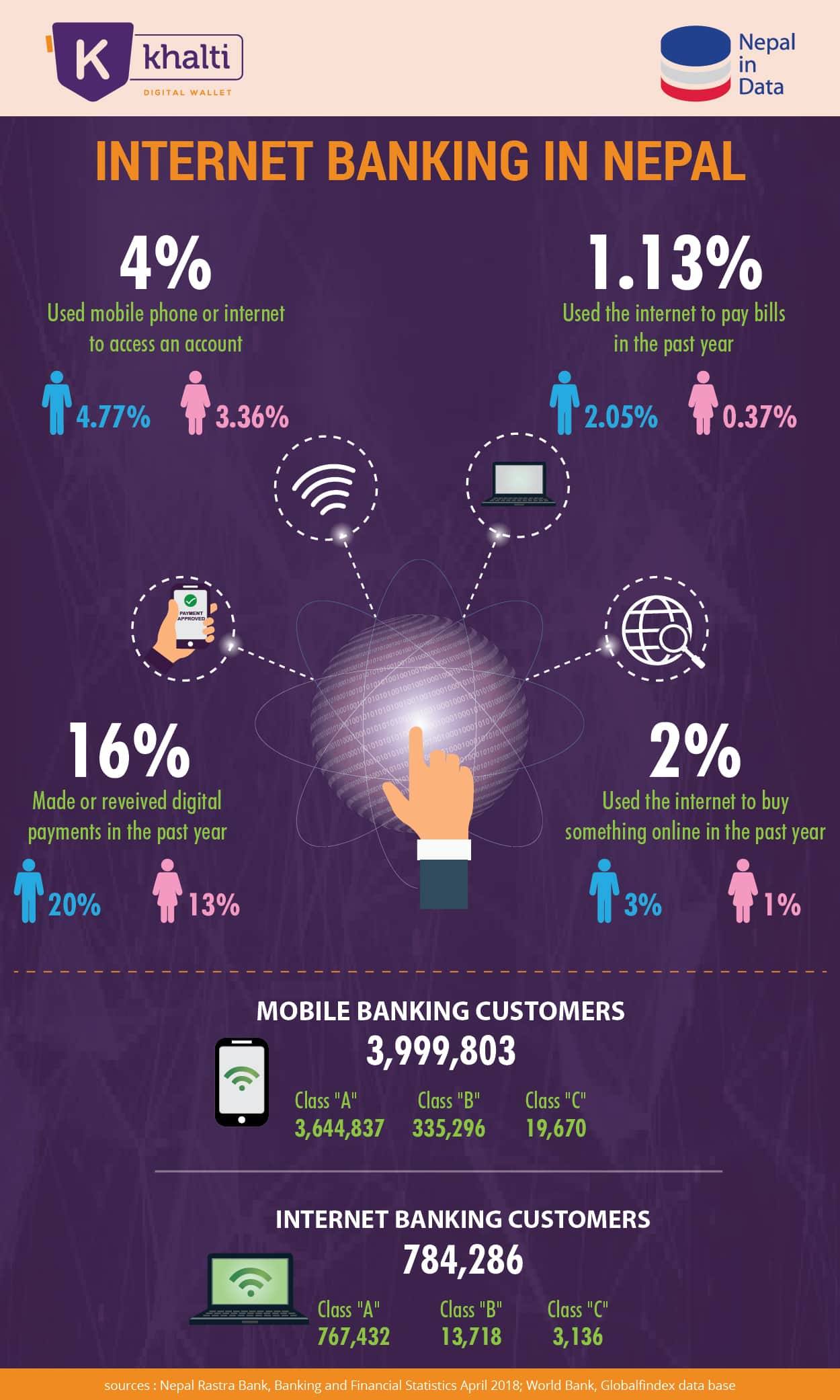

Financial institutions in Nepal are serving nearly 4 million mobile banking customers and 0.78 million internet banking customers, as per the recent data from Nepal Rastra Bank. The adoption is pretty slow, it seems. In the past year, only 2% used internet to buy something online. And, only 1.13% of the adult population has used internet banking to pay bills. However, 16% made or received digital payments in the past year. It shows, people are going cashless, though very slowly.

At a time when only 45% of the adult population has a bank account, banking and financial literacy is very essential for the growth and adoption of internet banking in Nepal.

As per NTA data from mid-September 2018, 53.12% of the population (15.58 million) has access to broadband internet in Nepal. And, more than 8.7 million Nepalese are expected to be using Facebook in Nepal (Dec 31, 2017). This is an absolute evidence of the mass movement following a trend in the online space.

What services are available with internet banking?

Some of the services accessible through Internet banking in Nepal are:

- Online tax payment

- access the account to check balance,

- online trading of shares,

- online remittance of money,

- electronic bill payment system,

- transfer of funds from one customer’s account to other, etc.

The future ahead

With smartphone penetration sharply going up due to competition in the telecom space, cost-effective models being available and expansion of Wi-Fi/4G/3G networks, mobile and internet banking is expected to see an accelerated growth in Nepal.

Internet banking in Nepal is set to become the catalyst for change in the way money moves. Online banking means access to banking anytime anywhere. Internet banking can create a whole new set of customers who do not have access to formal banking at present. Mobile phones provide penetration and an entry into a customer segment that banks could not earlier reach, ultimately increasing access to banking and financial inclusion in Nepal.

The government has decided to implement the Electronic Payment System in the payment of its expenditures and collection of revenue. Now, it is possible to pay revenue and all forms of taxes to government from your mobilephone. The system is currently available at the Taxpayers’ Office in Thamel in the first phase. The government in its latest budget has also announced to run a special campaign to open a bank account of all Nepalis within a year. It will surely offer an enormous opportunity to promote internet banking and digital payments, and ultimately move towards less cash and cashless society.

Infographics partner: Nepal in Data

Hello there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really enjoy your content.

Please let me know. Cheers